MEMO: CPP2 – Enhancement

MEMO: CPP2 – Enhancement

TO: All Staff

FROM: Clara Young, Director of Finance & Administration

DATE: April 11, 2024

Re: CPP2 – Enhancement

Effective January 1, 2024, employers are required to deduct the new Canada Pension Plan Enhancement (CPP2) on earnings above the annual maximum pensionable earnings.

What is the CPP enhancement?

From 2003 to 2018, employees were making a contribution of 4.95% on their pensionable earnings up to their annual maximum pensionable earnings (first ceiling), with employers making an equal contribution. These are the base contributions to the CPP.

From 2019 to 2023, the contribution rate for employees was increased gradually from 4.95% to 5.95%. These are the base contributions (4.95%) and the first additional contribution to the CPP (1%).

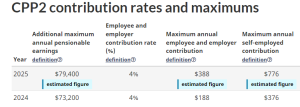

Beginning in 2024, an additional maximum pensionable earnings (second higher ceiling) has been introduced. Employees and employers are required to make a second additional CPP contribution (CPP2) on these earnings, beginning at the first earnings ceiling and going up to the second earnings ceiling, at a rate of 4.0%.

For 2024, once you have reached the CPP maximum of $3,867.50, the CPP2 deduction will begin for those whose pensionable earnings exceeds $73,200.00. The maximum contribution for CPP2 for 2024 1s $188.00.

The enhanced CPP Contributions, known as CPP2, will appear as a separate line in your pay stub, as well as on your T4s.

How does CPP enhancement affect employee pensions?

The enhanced CPP will increase retirement, survivor, and disability pensions for employees in the long term for all contributors. The increment is a long-term adjustment and will fully materialize after about 40 years of making contributions, increasing the maximum retirement contribution amount by 50%.

If you have any concerns or questions, please contact:

- Joanne Wicklund, Finance Manager, via email at JoanneW@tikinagan.org, or ext. 2261

- Tasha Jewell, Finance Manager, via email at TashaJ@tikinagan.org, or ext. 2270

Thank you for your cooperation.